13 Things I Learned Reading a 225 Page Report About the Gaming Industry

A quick poll for readers before we get started - you may have noticed there’s a lot of politics going on in the world right now. The main focus of Infinite Scroll is social media and how people interact with each other online. That means I write about politics semi-often, because so much of what’s happening intersects with politics. But I’m never quite sure if the amount of politics in the blog is too much, too little, or just right. So! Here’s a poll for you to vote in:

A: Not enough politics. You love the political posts. You want more politics, bring it on, no holding back

B: You think Infinite Scroll does a pretty good job balancing political and non-political topics

C: Too much politics. You mostly enjoy the blog, but wish there was less politics.

Feel free to leave more detailed thoughts in the comments. Particularly if you’re a paid subscriber - sorry to the rest of you, but the fact that I have a mortgage means that paid subscriber opinions are more important than yours.

Onto the post!

Over the last week I’ve been reading an absolutely phenomenal 225-slide PowerPoint presentation from analyst Matthew Ball about the state of the video game industry. I realize this is the world’s worst pitch to click on a link - it’s a PowerPoint deck hundreds of slides long! And I am telling you to read it anyways. It flows incredibly well and is absolutely packed with insights. But experience and blog metrics tells me that few people actually click the links, so if you can’t be bothered here are 13 of the most important insights I gained about the video game industry from Ball’s work.

Gaming is much larger than most people realize

Internationally, the worldwide box office for the film industry was about $30 billion in 2024. That includes both Hollywood films and internationally produced films. Gaming is more than six times larger - revenues for the gaming industry were $200 billion last year.

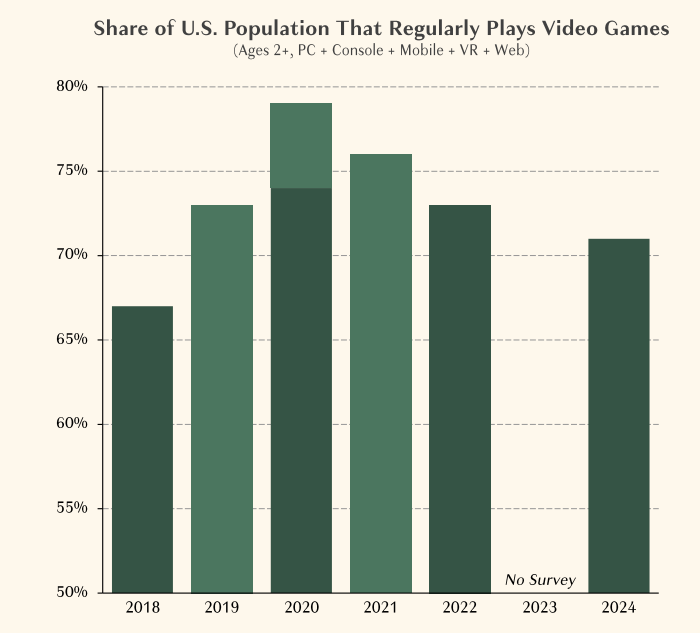

Gaming is sometimes still treated as a niche hobby, or as a less serious form of entertainment compared to film, television and books. But the gaming industry is roughly as large as the books, music and film box office industries put together! It’s a commercial giant that has eclipsed the more ‘serious’ and historically significant entertainment sectors. More than 70% of Americans play video games regularly. Gaming is the mainstream of entertainment now.

Gaming is currently in a years-long slump

How did gaming become so large? From 2011 to 2021 the industry grew at a rate of 10% per year (in real terms). That’s three times the rate of real GDP growth worldwide. Gaming went from a 75B industry to a 200B industry in ten years.

But since 2021, the industry has completely stagnated with zero growth even in nominal terms. Most analysts expected growth to continue, and they’ve been wrong.

This can’t be explained by a generalized post-pandemic slump for content. Nominal spending on books, music and digital video has increased 2021-2024, so something is happening here that’s video game specific. In fact, after hitting an all time high in 2020 the share of population who regularly games is declining.

Game studios have been hit hard

VC funding of the games industry has declined 77% in the last few years. There are fewer venture deals being struck and those deals are smaller than before. This mix of declining investment and flat sales has led studios to cancel dozens of major games and projects - what looked viable in the heyday of 2021 no longer seems commercially appealing in 2024.

There’s also been an uptick in studio closures and layoffs in the industry. And the majority of major gaming stocks are significantly down from 2021:

The 2011-2021 golden years were powered by a number of overlapping trends that boosted the industry. The growth of the mobile games industry and app stores, free-to-play models powered by microtransactions, the rise of social gaming, battle royales and cross-platform gaming (to name a few) all contributed to the rise. But most of those trends have either slowed or hit a logical end point. There are few games left that could add microtransactions but haven’t. The platforms have all been integrated.

And the potential growth drivers post-2021 haven’t worked out. AR/VR games remain a tiny niche without widespread adoption. Crypto/NFT/web3 functionality is a massive bust. Esports haven’t driven increased playtime or new eyeballs. There’s no growth driver right now.

Smartphones have gone from an opportunity to a threat

Mobile gaming is responsible for well over half the total growth from 2011-2021, and is now more than half the gaming industry:

The problem with mobile dominating growth is that there are few places left for mobile to grow. Everybody’s already got a smartphone with an app store, there are no more users left to add. To add new mobile gamers, you’ve either got to wait for new gamers to be born or add smartphones in low-income developing countries (where there’s little income to spend on games in the first place). That well has simply run dry.

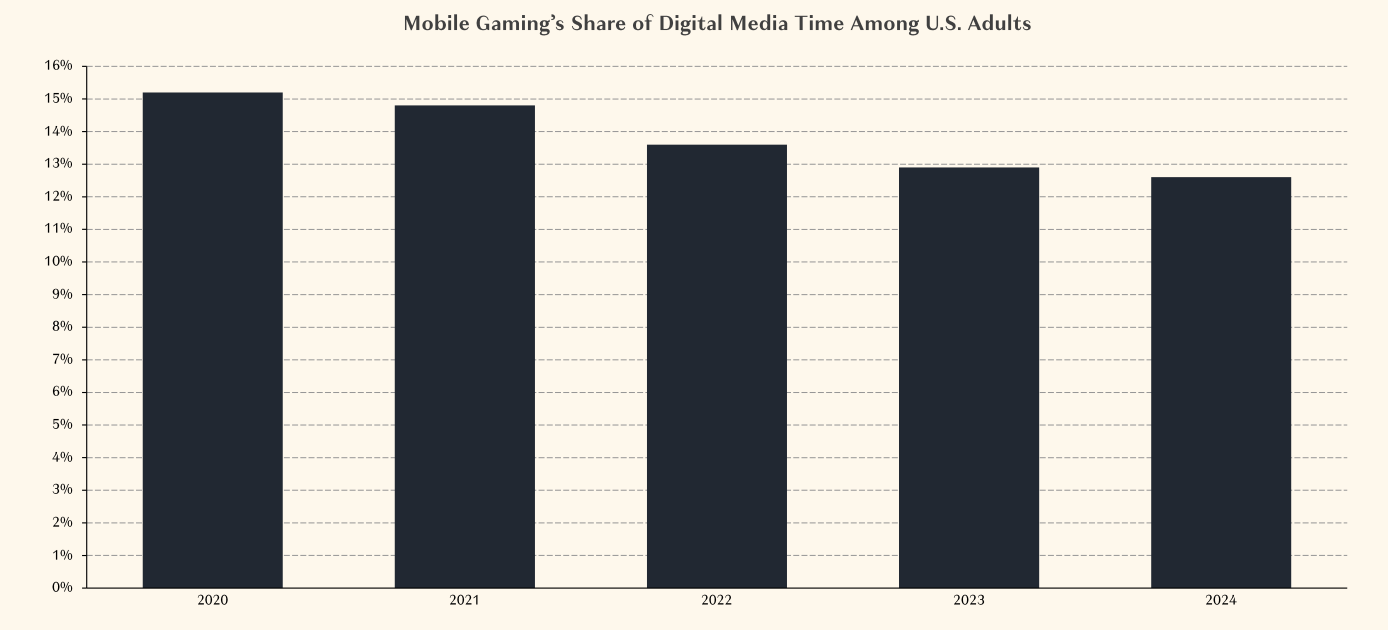

And worse, the competition for user attention has gotten way, way more pronounced in the last three years. This basically comes down to one thing - shortform video. It’s TikTok, folks.1 TikTok usage is skyrocketing and that’s time that could be used for mobile gaming.

Shortform is a particularly deadly competitor here for mobile games. You’re on a bus, or a train, or waiting in a lobby for 15 minutes - that used to be time devoted to playing Candy Crush or some other game. But TikTok fills that time now, and it does it seamlessly. It’s near instant entertainment, you can use it for 30 seconds or 30 minutes seamlessly, and it’s winning the battle for user attention. TikTok isn’t cannibalizing other social platforms, because hours spent on Instagram and YouTube are also increasing. It’s cannibalizing gaming. Mobile gaming’s share of attention is dropping:

On top of the competition from China, there’s increased focus on app store policies. Ball’s analysis is that Apple and Google made over $20B in revenue from taking their cut of mobile game sales in 2023 - a number that is almost pure profit with little overhead. That $20B would be significantly more profit than all games publishers combined.

But mobile isn’t the only challenge that the industry is facing.

Gaming is now dominated by years-old titles

This is something I called out in late 2023 - new games are having an increasingly difficult time breaking through. The industry is dominated by games that are, in some instances, older than the users playing them. I listed the best selling PC games in late 2023 with publishing dates:

Gaming today is dominated by decade-old games and games which get a new installment every year like Call of Duty or FIFA. The number of newly released, non-franchise games that breakthrough every year seems to be decreasing over time. This may seem like it’s not an issue, but this chart should scare any new game developer:

Only 15% of playtime on Steam comes from games released in a given year! Older games simply dominate the market.

This is a cup half full/empty situation. It’s great that there are games like Fortnite and Minecraft that have real staying power and cultural relevance. But there’s real reason to worry that their success may come at the expense of the next generation of games.

Gaming is incredibly top heavy

The five most played franchises in PC gaming - Call of Duty, Counter Strike, Fortnite, League of Legends and Minecraft - accounted for 30% of all playtime by themselves. On console, the top five is Call of Duty, NBA 2K, FIFA, Fortnite and Grand Theft Auto and they make up an astonishing 43% of playtime!

If you’re releasing a new game, the situation is somehow even more grim than that: among new games, the results are still incredibly top heavy.

Only 6.3% of playtime in 2023 went to non-annual games released in 2023. And if you’re fighting for that 6.4%, half of that went to just the top four games. The fact of the matter is that some games have such strong gravity that they can essentially hold their player bases in perpetuity. Many people aren’t general purpose gamers any more - they’re specifically FIFA gamers, or Fortnite gamers, etc. They’re not in the market for a new game.

VR won’t save games

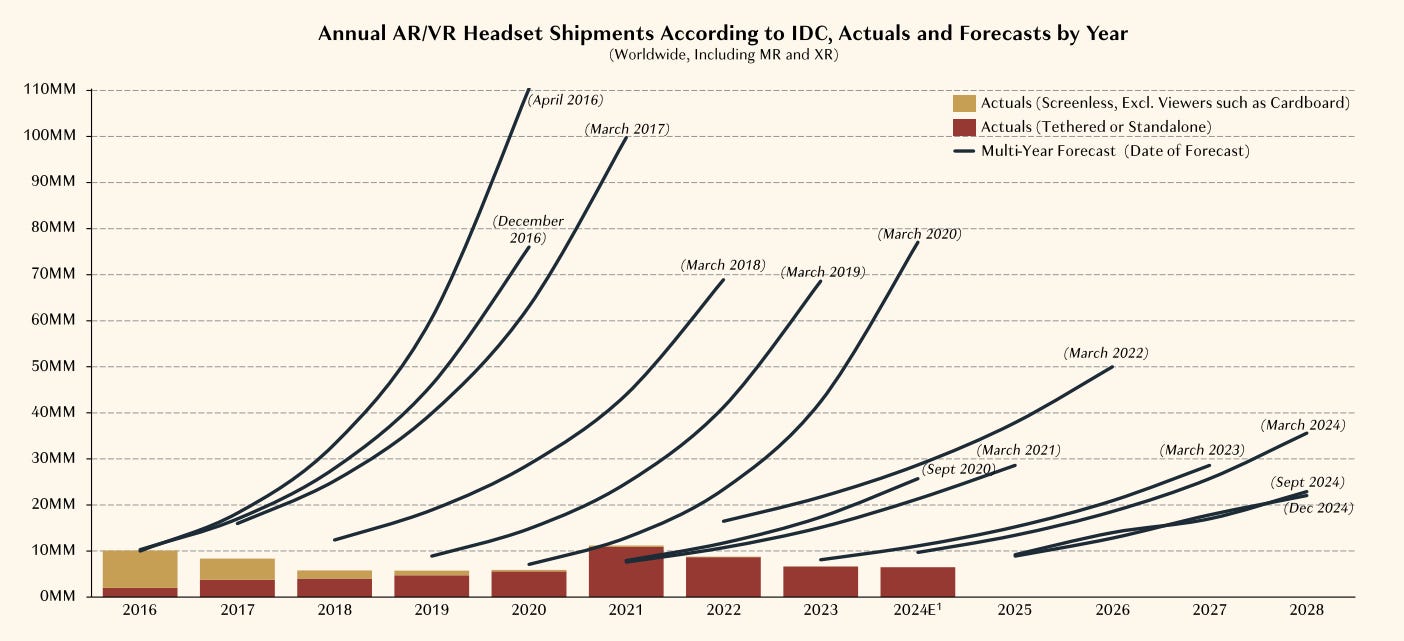

I’ve been a vocal skeptic of VR headsets for as long as companies have been releasing them, and it’s gratifying to see Ball validate my skepticism. VR has almost continually been pitched as a rising force and almost continually falls short of industry projections:

The number of VR units being shipped is actually down around 40% from 2021 to 2024. It’s a remarkably bearish indicator for the entire theory of VR - even as we’ve gotten the most advanced headsets in history, users don’t seem to care. Meta has spent more than $80 billion on its VR/AR/Metaverse projects since 2014 and has almost nothing to show for it. The Apple Vision Pro was such a disappointment that Apple’s stopped producing them entirely.

Consoles are stagnating… except for Nintendo

Nintendo has been on fire the last few generations of consoles. The Switch is arguably the most successful console of all time2, and the Wii did a better job at bringing traditional non-gamers into the market than any console in decades. But competitors Xbox and PlayStation simply haven’t had the same success:

Nintendo has a distinct approach - they don’t target the highest end games or the most technically impressive performance. Instead, they focus on usability and form factor and what’s fun for the casual gamer. This has clearly been a huge success.

What’s even more remarkable for Nintendo is that they mostly sell their own games. More than half the games purchased for Nintendo’s consoles are produced by Nintendo, compared to around 10% for Xbox/Sony. Consoles aren’t where the real money is - they’re often sold for little profit or even a loss, so that the companies can make money selling you lots of games. But Nintendo makes far more per game sold, because they’re getting both the console’s cut and the studio’s cut of the profit.

The Switch 2 comes out later this year, and it looks like it’s going to be a mega-hit. We’re likely going to see a continuation of Nintendo’s dominance.

PC Gaming is still growing

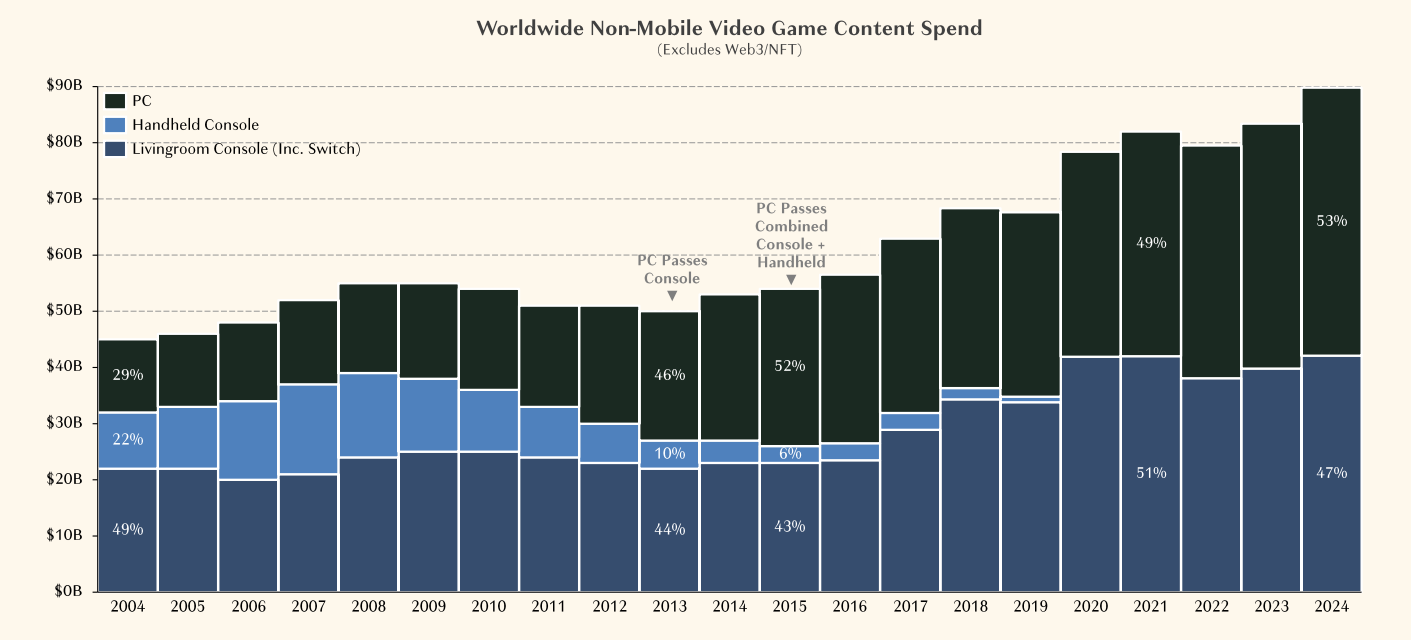

PC has been a steadily increasing force in the industry, and has even continued its growth post-2021. It’s now more than half of non-mobile gaming spend:

PC has a set of advantages over console gaming that will be hard to overcome. PCs have advantages on the low end - barriers to entry are near zero since almost every family already has a computer. Many popular games can be played on even the oldest, slowest computers. Many games are completely free to play. Indie games have thrived on PC, offering lower price points and more creative play than traditional AAA titles on major consoles.

At the same time, PC also has advantages at the top of the market. If you care about performance, a top-end PC will always graphically outperform a console. If you’re a competitive gamer, keyboard-and-mouse is proven to be a better form factor for serious competitive gaming than a controller. And PC offers a much, much larger catalog of games than any given console.

Ease of use is also high on PCs. You can easily play a game while multi-tasking and checking email. You can easily alt-tab over to a browser to search for tips and tricks if you’re struggling with a game. It’s just a more seamless experience than booting up a console.

The growth of China

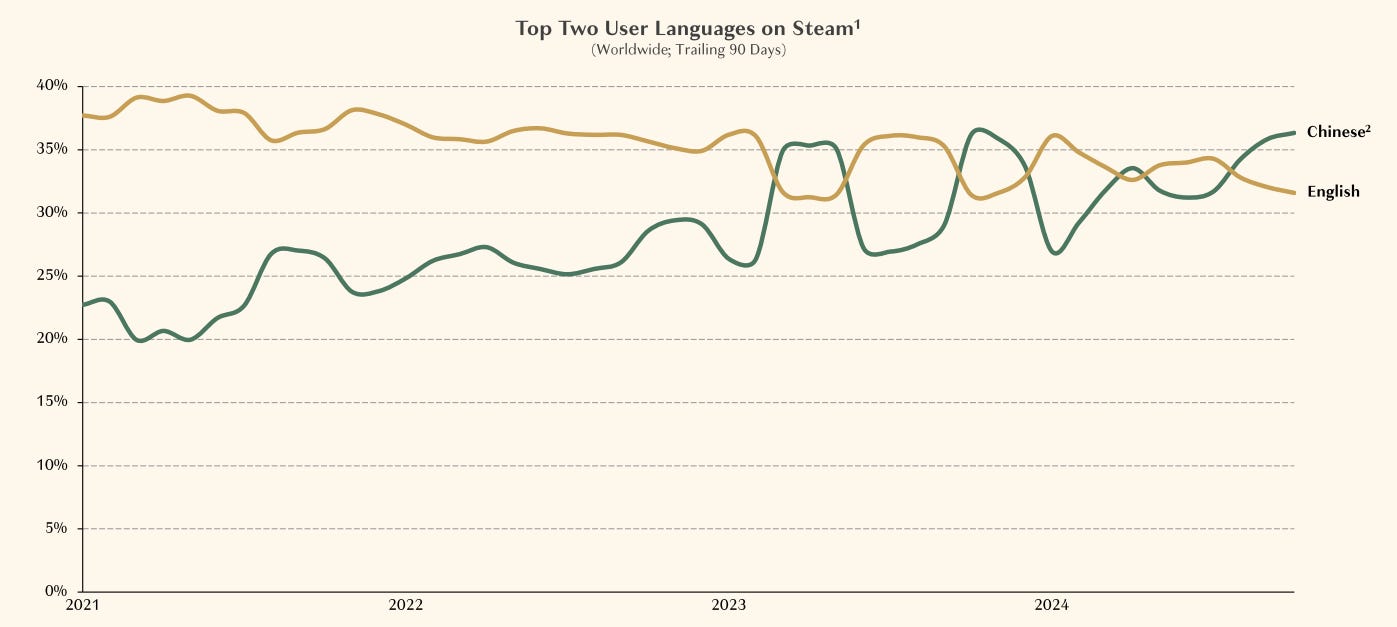

One more fun fact about the PC market: Steam is now mostly a Chinese platform. There are more Chinese language users on Steam than English language users.3

Total playtime on Steam peaks when China gets off work and most of America is asleep. And this tells us where future growth in the industry might come from.

China’s games industry grew even faster than the rest of the world’s from 2011-2021, going from around $7B in sales to more than $40B. But most of that growth has benefitted Chinese game developers, not Western or Japanese developers:

In fact, Chinese titles are now seeing success not just in China’s market but worldwide. Genshin Impact is a global mega-hit with $5 billion in sales in China and $4 billion in sales in rest of world. Games like Marvel Rivals and Black Myth: Wukong are also breakthrough hits developed in China.

Black Myth: Wukong is particularly notable here in that it’s a game that’s not just made in China, but made for China. It’s inspired by classical Chinese literature. It’s distinctly Chinese in themes, tone and was made with a Chinese audience in mind. We’re going to see more of this in the future, and I wouldn’t be surprised if even Western studios started focusing their games around Chinese themes to take advantage of that market.

Games are cheaper than ever before

The price point for a major studio game has been remarkably sticky over time. In the mid-90’s, when dinosaurs roamed the earth and yours truly was a child, Super Nintendo games usually cost $50-70 depending on the title.

That price point has not meaningfully changed for decades, meaning that in real terms AAA games today are cheaper than they’ve ever been. A $60 dollar game in 1992 would be the equivalent of a $132 dollar game in inflation-adjusted dollars. Gamers, to put it lightly, would riot if standard games cost that much.

And this is leaving out the many cheaper options. Indie games like this year’s smash hit Balatro often cost only $15-20 dollars, or less. Steam has multiple sales events per year where games can be purchased at steep discounts, while other stores like Epic routinely give away notable games for free in promotions. And many of the most popular games are outright free to play, making their money through sales of cosmetics.

This creates enormous user value - the amount of entertainment hours per dollar spent can be outrageously high for games today. But it’s hard for the industry to grow when prices remain stuck like this, and it’s why microtransactions, loot boxes, DLC and battle passes have become such a prominent feature of so many games. There’s no other entertainment industry - books, movies, streaming, etc - with this problem of being stuck with a decades old price point.

Even as prices stagnate, making AAA games is harder than ever

It’s a paradox - even as games are cheaper than they’ve ever been, they’re also higher quality than they’ve ever been. The biggest releases feature graphics and performance that would absolutely stun players from 10-20 years ago. The technical achievements are phenomenal, the worlds are more open and interesting than ever, the gameplay is more complex. And therefore making these games has gotten harder:

Budgets keep increasing as well. Major releases now routinely have budgets in excess of $200 million, and those numbers keep rising. Halo Infinite was rumored to have a budget in excess of $500 million dollars!

Roblox bucks the trend

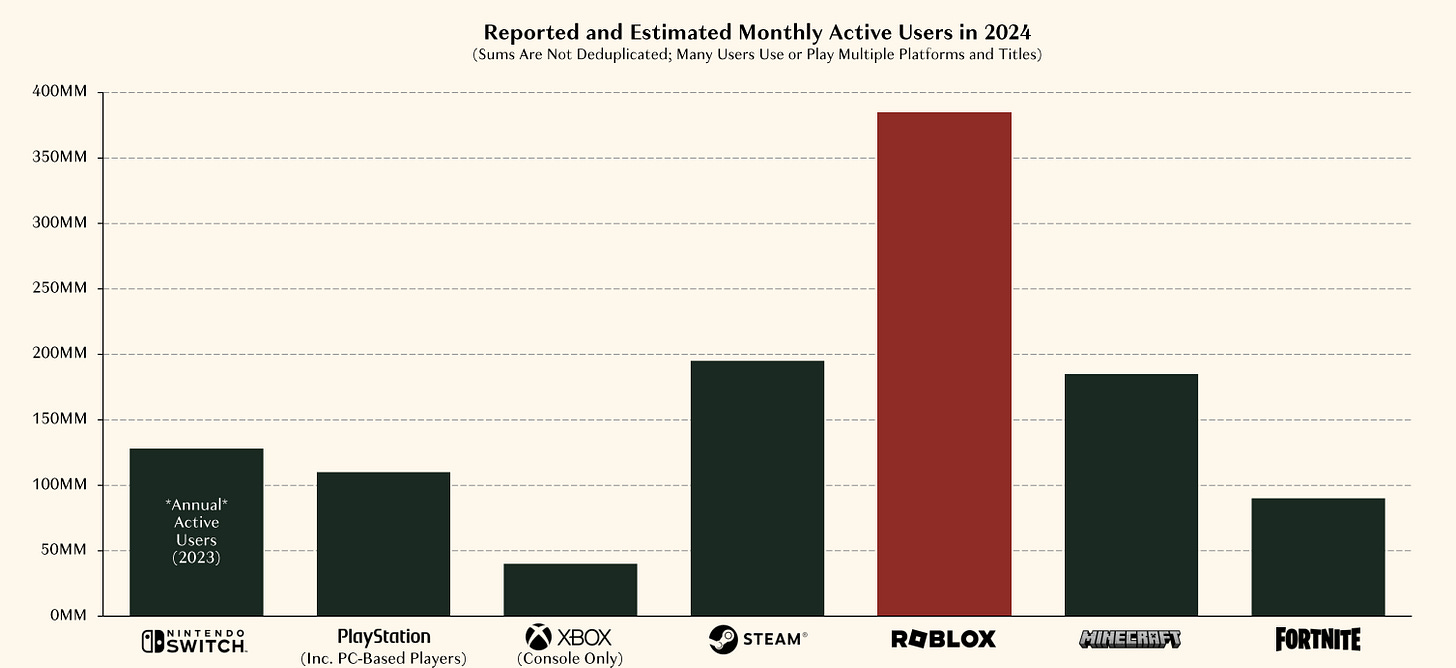

However big you think Roblox is, it’s bigger:

You are correctly reading that Roblox has twice as many monthly users as the entire Steam platform. It’s hard to overstate how many players this game has. The subgame ‘Blox Fruits’ had almost as much total engagement in 2024 as the entirety of Blizzard Entertainment as a company. Roblox content dominates content - last year people spent twice as much time watching Roblox content on YouTube and Twitch as they did on the entirety of Disney Plus. And Roblox’s fanbase is very young and growing.

Roblox also provides a potential answer to ‘where does the growth come from’, because Roblox is a platform inside which creators can create their own games, their own worlds, their own cosmetics, etc. It’s less about winning a traditional game (kill the bad guy, hit the high score) and more about creation. The metaverse is real, it’s just called Roblox (and doesn’t require a VR headset). Minecraft and Fortnite are also moving in that direction.

But all that positive spin has an obvious downside - Roblox, despite its size, is still deeply unprofitable. It’s free to play and simply doesn’t generate enough revenue yet to offset costs. Ball has written at length about Roblox’s profitability problem here.

This is way longer than a normal post, so I’ll end it here. But I really can’t recommend Matthew Ball’s work strongly enough. There’s far more in his full, 225-slide presentation. Check out his site Epyllion for more great analysis.

Along with YouTube Shorts and Instagram Reels, which are gaining marketshare. But in the interest of brevity, we’ll just say TikTok.

Third in all time sales, but not far behind first place. And in a much tougher competitive environment.

Why is Steam one of the very few Western tech platforms not banned in China? I legitimately don’t know, and I’d be fascinated to read about how that happened.

>Price of games has basically halved from inflation

>Costs of developing games has exploded

>One financial flop can shutter a studio

Reddit: How dare you propose raising the price! Don't you know about muh marketing budget? Just cut that. Corporations are just greedy. MTX- bad, lootboxes- bad, paid DLC- bad, premium special editions- bad, preorder incentives- bad, battlepasses- bad, Steam sales- good, r/patientgamers- good. Only a sucker would buy a game at full price.

*Beloved studio #5000 this year announces a wave of layoffs*

Reddit: This is capitalism's fault.

Thinking about games costing the equivalent of $120+ when I was a kid really goes a long way to explain why we only got a few new games every year, and we treasured them. At $60, even $70, I can basically afford to get anything that interests me if I want it even a little, and so many end up either abandoned at some point or played through once and then never again. It's a meme that every Steam gamer has dozens of games in their library that they bought on sale and never played.

Is there any meaningful distinction between mobile apps like, idk, Angry Birds and classic video games in any way or is it basically one undifferentiated market? I’m thinking in terms of market share, demographics, complexity, time spent, anything. As you can tell from the outdated example, I’m not a gamer. But at the very least, it seems to me when someone self-identifies as a gamer, they mean PC games / video games and not app-based mobile games. Maybe that’s the only distinction.